Innovation in the insurance industry is dependent on an insurer’s line of business. Some lines end themselves more readily to innovative strategies than others. In insurance sectors where competition is fierce or regulation has undergone significant change, innovation provides a way for a company to gain a sustainable advantage.

The degree of complexity and scalability also affects the extent to which innovation can transform a particular line of business. Many annovative tools and techniques already available can be easily applied to less complex underwriting and claims processes. Some lines, such as personal auto, have demonstrated innovative leadership; others, such as medical professional liability (MPL), have proven more challenging for insurers to implement widespread innovative strategies.

Insurers in lines that are highly complex or subject to significant litigation risk and entrenched regulation, such as MPL, may experience less pressure to innovate. Those distinctions are important when assessing a line or a company’s innovation capabilities. Regardless of the line of business, however, a company’s unique characteristics factor into both the implementation and impact of innovation.

For instance, even in the same line, the competitive position of a small regional insurer could be quite different from that of a national writer; this means its innovation needs could also differ. When assessing the impact of innovation on a company’s rating, AM Best considers not only the line of business, but also circumstances specific to the insurer.

In an effort to assess insurers’ ability to innovate as a component of their financial strength, AM Best recently rolled out an innovation assessment. This component of the business profile building block is designed to determine if a specific company’s innovation—or lack thereof—enhances or detracts from its long-term financial strength.

Innovation score ABCs

AM Best defines innovation as a multi-stage process whereby an organization transforms ideas into new or significantly improved products, processes, services, or business models that have a measurable positive impact over time, and enable the organization to remain relevant. These innovations can be created organically or adopted from external sources. They can take many forms and are not limited to a particular type of innovation or technological development. For example, innovation adopted from external sources may prove to be the most appropriate path when there are internal barriers to innovation in an organization. A subcomponent of the business profile building block, AM Best’s innovation assessment does not automatically translate into a positive or negative rating factor. Given a company’s particular business profile assessment, AM Best also examines if innovativeness enhances an insurer’s long-term financial strength. However, given the accelerating pace of change, insurers that fail to embrace innovation may be subject to rating pressure over the long term as they may find it difficult to compete amid potential loss of relevance in the market.

In contrast, insurers that embrace innovation may find it easier to grow market share and improve efficiency, providing them the opportunity to enhance their financial strength. There may be instances where lower-rated companies score well on innovation, as well as cases where higher-rated companies have more limited innovation abilities. Similarly, a company can receive a lower balance sheet assessment due to geographic or business line concentrations, but still receive a favorable innovation assessment.

AM Best expects the output of the innovation process—those new or significantly improved products, processes, services, or business models—to have a measurable impact. Reinventing how insurance-based products and services are sold in the future will no doubt have an impact on bottom-line profitability.

Innovation is a dynamic and ongoing process, as well as a longterm commitment. Companies receiving the highest innovation scores will demonstrate their success in innovating through measurable results. These are companies that treat innovation as part of a continual cycle of organizational growth and development, and successfully integrate their new-stream innovations into their mainstream legacy operations.

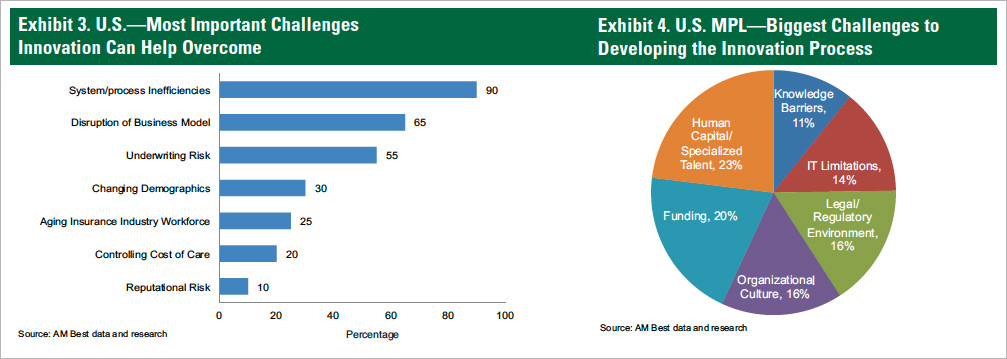

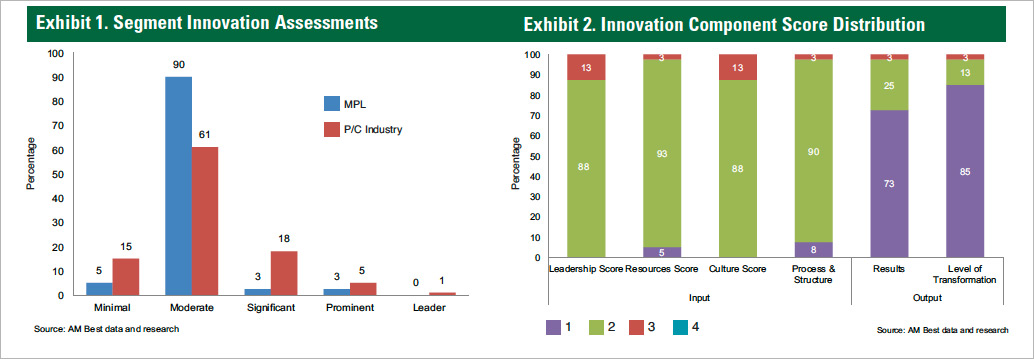

Based on AM Best’s Innovation Assessment results, the MPL segment lags the overall property/casualty (P/C) industry, as 95% of rating units in the segment scored in the bottom two innovation assessment profiles (90% Moderate, 5% Minimal) (Exhibit 1). The MPL segment has scored lower than most of the other P/C segments, with the large majority of MPL rating units scoring in the lower half in all of AM Best’s innovation components, especially on the output side (Exhibit 2).

For years, MPL insurers have been considered niche underwriters of professional liability products, only understood by a handful of specialty insurers operating in specific geographic regions that were controlled by those specific insurers. As such, insurer retention was high, competitive pressures were minimal, and encroachment by other insurers was rare.

Today, as the market continues to shrink, competitive pressures are at an all-time high. In recent years, the ability to retain policyholders has gone beyond premium discounts and dividends to specially designed funds that grow for the benefit of policyholders. But where does this sector go from there? Whether innovation can allow for business expansion and technology and data that helps the business transform through the creation of tools that better mitigate risk and lower costs for the policyholder are questions that still need to be answered.

To date, the MPL segment overall has not yet demonstrated a significant level of measurable results in this area. Failure is always a potential result of any innovation program, but without seeking out and trying new ideas, there will be no way to know if certain concepts can work. In terms of innovation, failure to explore can sometimes be worse than a failed outcome.

Some MPL companies have been enhancing their businesses by leveraging technology to enhance back-office efficiencies. However, AM Best does not generally consider upgrades to policy administration systems and legacy systems to be innovative, but more of a competitive necessity. In an innovation survey conducted by AM Best of its rated entities, MPL companies listed system/process inefficiencies (90%), disruption of business model (65%), and underwriting risk (55%) as the three most important challenges innovation can help them overcome (Exhibit 3).

How the sector can innovate

The MPL sector has been one of the better-performing sectors in the P/C industry during the past 10 years. However, a vast majority of MPL companies have begun to see a rise in “nuclear” verdicts and average indemnity losses much higher than historical averages due to social inflation. In addition, customary defense tactics are no longer applicable in certain situations.

As such, claims settlements and legal costs have been rising at alarming rates and underwriting results are weakening in response. Given the nature of this business, loss adjustment expense ratios for MPL insurers continue to be multiples of most other insurance sectors. Since MPL insurers pride themselves on claims defense, it could be an area ripe for new techniques and processes that lead to better outcomes and lower defense costs.

However, changes in claims management philosophy and practices can sometimes lead to unintended consequences; thus, many MPL insurers can be reluctant to introduce new practices despite the possibility of long-term benefits. Milliman’s Datalytics product is a recent example of a tool MPL insurers have adopted to lower attorney billing and loss adjustment expenses.

Not all innovation initiatives need to be purchased. Some can be developed in-house. MPL insurers noted in the AM Best innovation survey that talent-related concerns are the top challenge to developing an innovation process (Exhibit 4). In those cases where MPL companies see the benefits of customization but do not have the in-house expertise, partnering with insurtech firms provides the opportunity to access and utilize externally developed information and techniques.

MPL insurers are always searching for more ways to help their insured physicians practice better medicine. Solutions driven by medical research, advanced analytics, and predictive modeling can help to enhance patient safety, promote better outcomes, and avoid future claims and legal costs. Companies have also reported the potential use of artificial intelligence to make better use of unstructured data—for example, scanning public records could reduce the amount of information needed from patients in the application process.

Beyond technology, like other P/C insurers, MPL insurers are aiming to become more consumer-focused and improve the overall customer experience. A more recent example of this is the initiative designed to offer products such as a full suite of financial products, including wealth management, equipment/working capital loans, credit card processing, and insurance agency services to its members.

This has become increasingly important to physicians who want to remain independent yet need to bear the costs of compliance related to the Affordable Care Act. Some are improving website navigation, particularly for mobile users. Encouraging patient feedback and using newsletters to provide health tips to patients can transform the doctor patient relationship, resulting in discernible benefits.

What lies ahead for MPL?

A considerable amount of consolidation has taken place in the MPL segment the last few years. Technological advancements and innovation capabilities may become more appealing characteristics for potential acquirers that want to leverage technology without using the resources to build it in-house.

Alternatively, they may decide to form strategic partnerships with a university or healthcare insurtech firm. System integration could be another hurdle depending on the type of technology acquired. The degree to which companies in the MPL segment have adopted innovation has varied, but most recognize that innovation is critical to their viability. Management teams will choose the path they believe is best suited to position their companies for future success.